2020: Year of the Stock Market Crash?

Sunday, February 2, 2020

I don’t know about you, but lately I’ve been getting these warning emails, investment letters, trading twits … calling for the apocalypse and the end of this almost 11-year-old bull US stock market started in March 2009.

Most of these predilections issued by those perma-bears who have wrongfully tried to call the collapse for many years now… lately, the reason given for the “incoming demise” has been centered on the pandemic risks of the coronavirus, and the dramatic impact it might have on the global economy like the SARS virus had back in 2002-2003.

Will they be right this time?

Trade only what you see and what the market is trying to tell you:

Like I said many times, you need to follow the price action. Personally, I am a technical trader. It means that I believe every piece of relevant information, including the final vote of the investors community are all being PRICED IN the level of the general index under consideration (for more about the main premises behind this logic of technical price analysis, check out our free course).

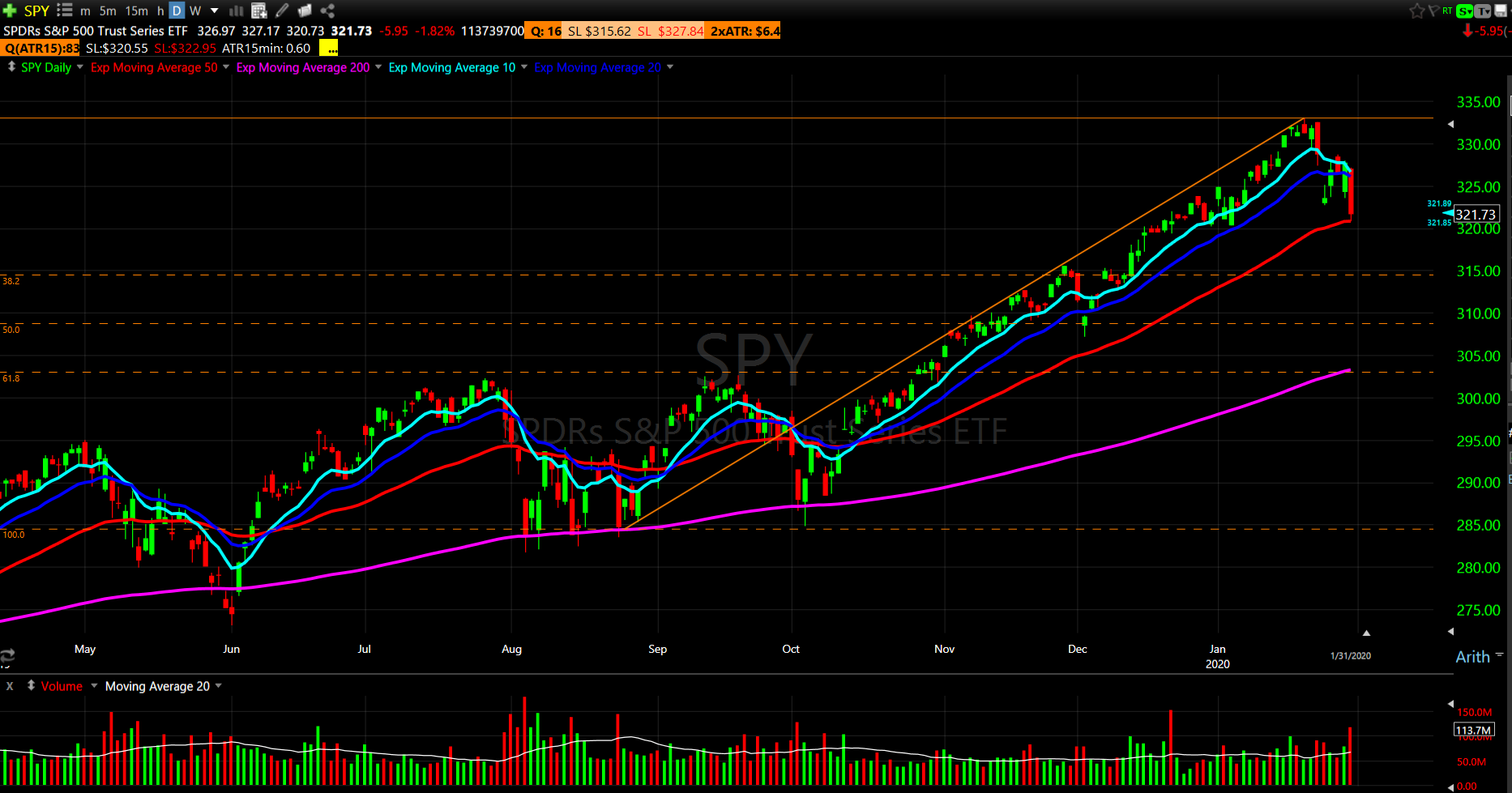

So if we consider the recent price action of the SPY (ETF version of the S&P500 index representing the 500 major US companies), we can tell that after reaching an all-time-high, we found some kind of resistance and witnessed a set-back for the past 2 weeks now (just a -3.7% drop below its all-time high so far), after the almost uninterrupted rally of 42% since the last real decent correction we’d had in Dec.2018 (where the market had gone down about 20%). So yes, it would be “fair” to say that the market has had a tremendous ride , and that perhaps a healthy correction might be in the making. But again, the most important is observation and not procrastination. So let’s look at our charts:

The last trading session showed a wide red candle along with strong volume on the way down but the index managed to find support on the important 50-day moving average. Usually, when the market does that, it will first “ping-pong” between its moving averages 20 and 50 day before deciding what it will do next. I personally reduced my stock related long term positions on the bounce back we saw at the beginning of the week, and now I remain in defense mode: If the SPY can manage to hold this important support level around 320 (3200 on the index), and if we see a healthy bounce back above the moving average 20 day (along with decent volume), then that will probably indicate that there is still healthy cash looking for a place in the US stock market… but if we CAN’T MANAGE TO HOLD THESE LEVELS, then my bet is that we’ll see a further correction that will bring us towards the 2nd important area of price support around 300-310 (3000-3100 on the index, that is about 10% below the all time high reached a couple of weeks ago). And that means that I will have to further reduce my long term stock related positions, if we break below the average 50 day , and wait to see what will the market do when we reach these important levels of support around the average 200day.

Manage you Risk

Which brings me to my 2nd important point: as an active investor, I actively manage my risk and positions. That means that I DON’T PASSIVELY SIT through a market correction of 10% or more. I am not your typical “long term investor” who sits through the peaks and valleys of market waves and tides. On the contrary, I manage market volatility and my positions according to the plan set in my strategy and risk management, which call for a mix of scaling in and out of positions, position size reduction while trading within the main defined trend of the market.Have a defined plan of action: a complete trading strategy

And that where it all starts: having a plan of action. Following a defined trading strategy day in and day out. For some, trading strategies can oscillate between holding positions for a few hours (Day trading), to a few days or months (swing trading), but no matter what your preferred time frame of action, you STILL HAVE TO FOLLOW A DEFINED METHODOLOGY. Without a trading plan, you‘ll just end up being “animal feed” into someone ‘else solid plan of action.Before going in a position, you should know exactly where you’re likely to exit, whether the trade turns out to be a winner or a loser; You should know the size that matches the exact risk you’re willing to undertake; You should know when to scale in or out of the position. All these pre-requisites are what constitute your plan of action, and define your investment process.

So, are we in for a big market correction?

So now you understand that as much as I’d like to give you a straight answer, I do not have a crystal ball, and therefore my answer would be as good as a flip of coin. But what I can tell you, is that no matter what the outcome is, I have my trading plan, and I will follow it religiously to trade my portfolio positions, only responding to what the market is telling me and not to what I think the market should do.PS: Part of my “active” portfolio, I look at a mix of day and swing trading opportunities. But I also keep an asset allocation which follows closely the rationale of Ray Dalio’s “All weather Portfolio” for my longer exposure (pension type of portfolio). I have managed this “risk parity” portfolio for the past seven years now, and because I understand that people don’t necessarily want to spend the time to trade actively, but still want to invest their hard earned savings into a RELIABLE ASSET ALLOCATION that can provide them with good risk to reward opportunities, I will spend some time in a next article talking about this “strategic” portfolio that I consider to be the one of the greatest portfolio of all.

#bearmarket #marketcorrection #trading #investing #coronavirus #portfolio #SPY #allweather #riskparity #assetallocation #tradingplan